Table Of Content

However, this size of a down payment isn’t typically required for a loan. It’s worth exploring your options with several lenders to see how much house you can afford. Before applying for a mortgage, review your financial readiness. Regardless of the length and type of loan you choose, you’ll need to meet certain loan approval requirements, such as an individual lender’s minimum credit score and maximum debt-to-income ratio (DTI). The length of the loan and the interest rate you qualify for will determine how much you pay in total interest. For example, if you opted for a 15-year mortgage with a 7% interest rate, you’d pay a total of $485,367 versus the $718,527 you’d pay with a 30-year mortgage at the same interest rate.

Home insurance

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. Being house poor means working double time to pay for a house you can’t comfortably afford. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point. Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay — $514,715 in total.

Compare mortgage rates for different loan types

Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. These are also the basic components of a mortgage calculator. One of the biggest hurdles when buying a home is saving for a down payment. Discover how to save for a house with 11 straightforward down payment strategies. Before pursuing a $300,000 mortgage, consider how long you plan to live in the home to determine if the costs benefit your long-term financial goals. With this payment schedule, you’ll pay a total of $718,527 over the 30-year period, with $418,527 of that going toward interest.

New buyers left owing €300,000 for uninhabitable 'mouldy' French home - The Connexion

New buyers left owing €300,000 for uninhabitable 'mouldy' French home.

Posted: Fri, 16 Feb 2024 08:00:00 GMT [source]

Monthly Mortgage Payments For Different Terms And Rates

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time. When looking at the monthly mortgage payments on a $300,000 loan, you might be thinking of an adjustable-rate mortgage as a great way to avoid paying more in interest over the life of the loan. An ARM is a solid option for many home buyers, but if you’re not prepared to make higher monthly mortgage payments in the event that interest rates go up, this strategy could hurt you in the long run.

This chart doesn’t include homeowners insurance, mortgage insurance or property taxes. The chart assumes monthly payments of $1,995.91 that are made on time, with no extra mortgage payments applied. If you can put 20% or more down on a conventional loan, you can avoid paying private mortgage insurance. Another factor in monthly mortgage payments is the length of the loan. A 15-year mortgage will have significantly higher monthly payments but a lower interest rate than a 30-year mortgage. The monthly payments for a $300K loan are $2,030.28 and $430,899.22 in total interest payments on a 30 year term with a 7.17% interest rate.

FAQs About Monthly Mortgage Payments On A $300,000 Loan

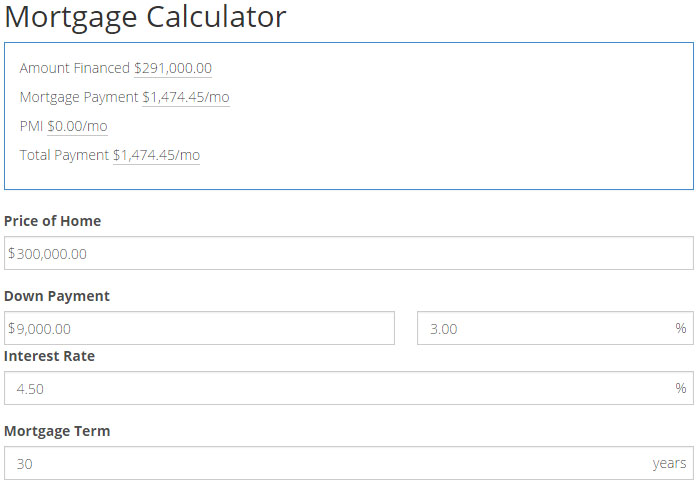

Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. The loan type you select affects your monthly mortgage payment. Explore mortgage options to fit your purchasing scenario and save money. How much you can afford to apply to a down payment can also influence the final numbers.

Mortgage Calculator

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Loan start date - Select the month, day and year when your mortgage payments will start. This formula can help you crunch the numbers to see how much house you can afford. Alternatively, you can use this mortgage calculator to help determine your budget. Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. However, if interest rates drop, you might consider refinancing to a fixed-rate loan.

Monthly Payment $300K Mortgage Over 30 Year vs. 15 Year

It’s also worth keeping in mind that the interest rate will almost always be lower for a 15-year mortgage. You might, for example, be looking at 6.5% for a 15-year mortgage, versus 7.5% for a 30-year mortgage. The monthly payment for a $300,000 mortgage is $2,030.28 over 30 years with a 7.17% interest rate.

Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments. Your interest rate and monthly payment will increase after the introductory period, which can be three, five, seven or even 10 years, and can climb substantially depending on the terms of your loan. Finding your dream home and dealing with sticker shock isn’t easy, but looking at the numbers can be the best way to determine if a purchase is the right choice for you. Be sure to add closing costs and other fees – such as those for an appraisal, an inspection, moving costs and potential repairs – to your overall house-buying budget.

The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S. Below is an example amortization schedule for a $300,000 loan on a 30-year mortgage at a 7% interest rate.

Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees.

If you’re home shopping and playing the numbers game, it can help to start with an understanding of what a baseline purchase price, such as $300,000, will look like in practice. Then, as you consider houses over and perhaps under that price point, you’ll better understand your options. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market.

Getting a mortgage preapproval will help you stand out when making an offer while providing you with a better picture of exactly how much house you can afford. Once you’ve completed your financial analysis, you can begin researching lenders. Find the one that best meets your needs and begin your application process. A little math can go a long way in providing a “how much house can I afford? Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

No comments:

Post a Comment